The Longwave Impact Newsletter: Know What You Own

Healthy eaters care about what’s in their food. Cyclists care about the material their bikes are made from. For passionate people, details matter, so of course investors who care about the planet want to know that the funds in their portfolio are authentic in their green and social credentials.

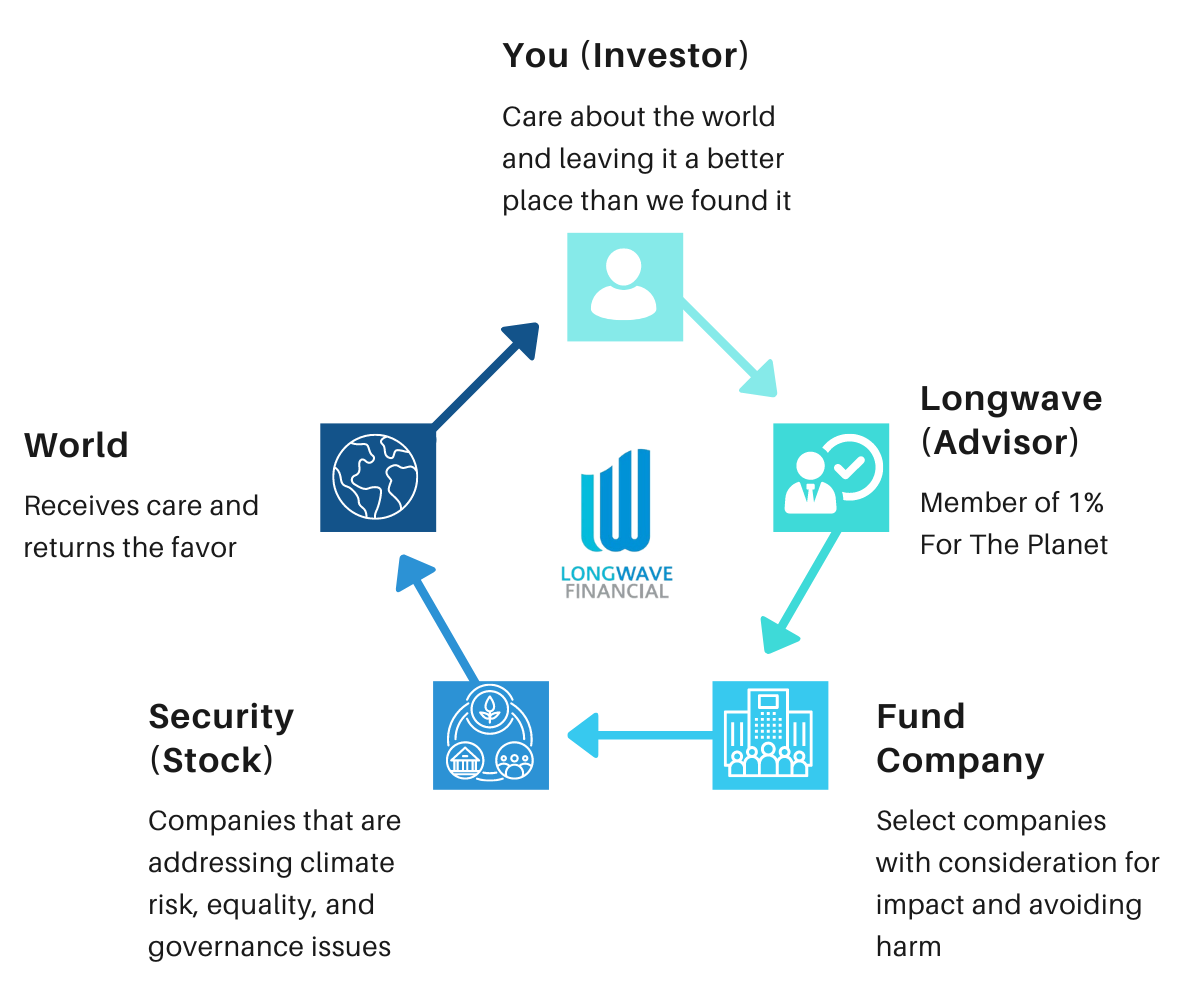

At Longwave, we believe in virtuous cycles.

For today’s newsletter, we will take a closer look at some of the positive actions being taken by two well-known fund families: Calvert and Boston Trust.

Given the urgency of the climate crisis and the importance of policy in advancing solutions, it is crucial that companies play a constructive role. However, companies generally don’t like change and are therefore unlikely to address future risks unless they are forced to by shareholders. And indeed, to be competitive, companies should be addressing these risks and capitalizing on emerging opportunities. Calvert and Boston Trust aim to invest in companies that are well positioned to minimize risk and produce sustainable returns.

There are a number of ways these companies do this including simply excluding bad actors, or conversely, to take shareholding positions and affect change through activism. It’s important to note that the largest fund companies in America such as Vanguard, Fidelity and Blackrock do not engage with the companies through shareholder voting even though they control trillions of dollars in capital.

Calvert

“As long-term investors, Calvert believes we have a responsibility to participate in corporate governance in order to create long-term value for our clients and positive change for our world.”

Calvert is a fund company that actively engages in the companies it owns. They do this through direct dialogue, shareholder proposals, and public policy initiatives. Examples of companies that Calvert has engaged with to drive positive change are Tesla, Starbucks, Xcel Energy, and Sempra. Since 2020 Calvert has engaged over 70 companies on just the issue of social reporting.

A recent engagement that Calvert led was with a trucking company called Paccar Inc, one of their holdings. Some brands they operate are Kenworth and Peterbilt. Calvert engaged with them due to concerns about lobbying against climate initiatives and the lack of a transition plan to lower carbon technologies. Calvert’s thesis was that Paccar would fall behind competitors due to standards on greenhouse gas emissions and changing consumer dynamics. Paccar was not receptive to Calvert’s engagement so they took it a step further and filed a shareholder proposal that would require them to report on climate lobbying in line with the Paris agreement. The thought is that if they are forced to do this it will lead to greater adoption of green technologies and better practices around transparency. The proposal got 47% support which certainly got the attention of management.

Boston Trust Walden

“Since the 1970s, Boston Trust Walden has used its role as an investor to address complex social and environmental issues. Through the levers of active ownership, we encourage the companies in which we invest client assets to adopt better ESG policies and practices because we recognize companies that effectively manage sustainability risks are better positioned for success.”

Based on their Annual Impact Report, here are some of the work Boston Trust Walden was able to accomplish in 2023:

Engaged with 179 portfolio companies on equality issues including advancing board diversity, building a more diverse workforce, and creating inclusive workplaces where all employees are respected, welcome, and supported.

Engaged with 94 portfolio companies on setting science-based GHG emissions reduction targets;

Engaged with 137 companies on climate risk issues including setting science-based GHG emissions reduction targets, developing climate transition plans, climate policy advocacy, and science-aligned lobbying.

Engaged with 92 companies on good governance issues including ESG disclosure, lobbying alignment, board and management accountability, and compensation.

Approximately 65% of companies held across Boston Trust Walden investment strategies had released workforce composition data in alignment with the EEO-1 report — a significant improvement from approximately 20% of companies doing so in 2021.

On this last point, we applaud Boston Trust Walden pressing companies to disclose breakdowns of employees by gender, race, ethnicity, and job categories, as this allows stakeholders to have visibility into the effectiveness of companies’ diversity, equity, and inclusion initiatives.

We believe that public accountability for hiring, retaining, and advancing people of color and women is essential to meaningful and enduring social progress and has been shown to be good business.

At Longwave, we believe that we are responsible for managing the climate and social risk in the companies we invest in. We also engage in regular discussions with portfolio managers on their thoughts and processes around screening out bad actors to ensure we are consistent with our principles. For learn more about the resources mentioned in this newsletter, please click on the links below.