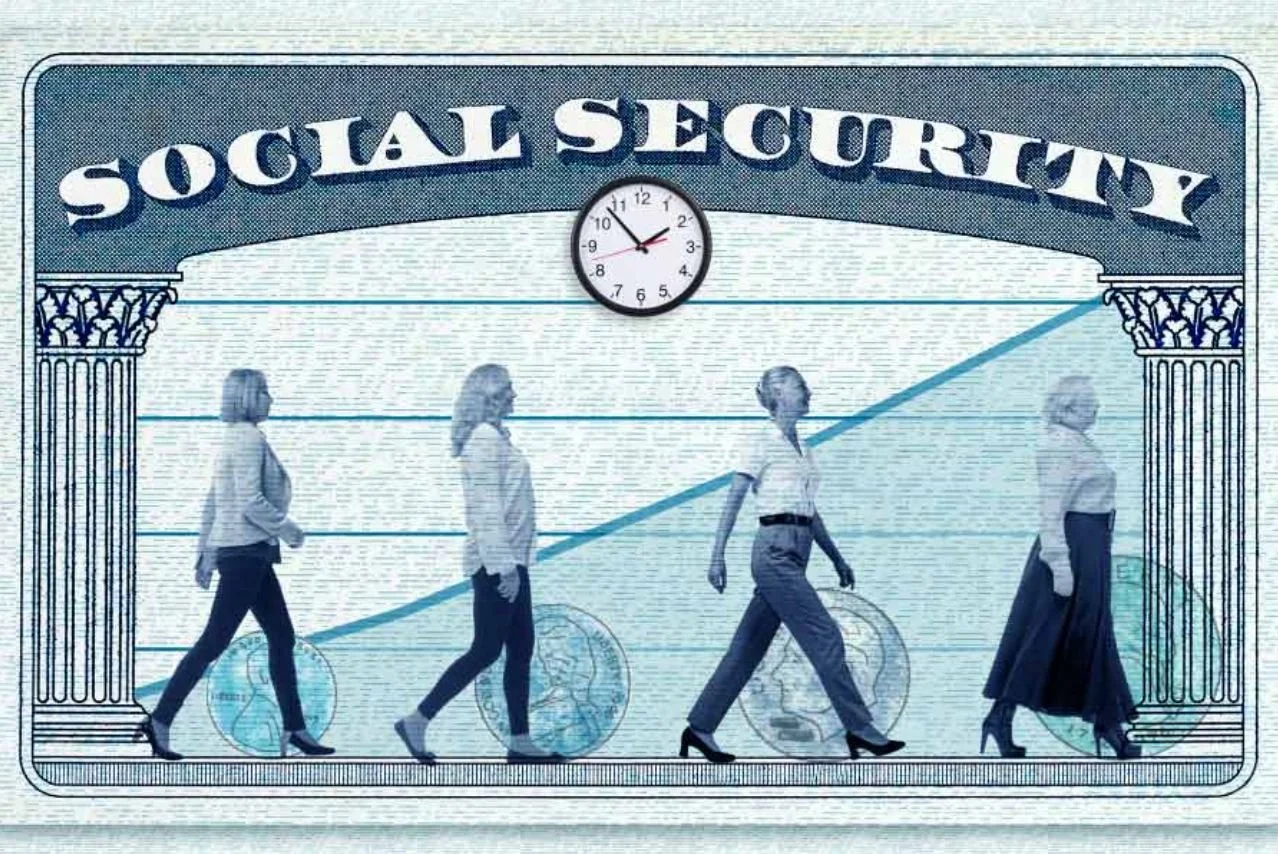

All About Social Security

There’s a lot of chatter today that the economy is getting worse. But there is just as much data saying the economy is in pretty good shape. Even if we see a dip, we believe in the market’s long-term resiliency. In any case, what happens on Wall Street day-to-day is out of our control. At Longwave, we prefer to focus on things we can control such as taxes, savings, diversification and investment expenses. Social Security is one such thing we can control. For many of us, Social Security will be the only guaranteed income stream we will have in retirement. While it’s vitally important to tens for millions of Americans, it can also be confusing and anxiety-provoking. Based on many conversations we have had with clients, two questions most often come up:

Will Social Security be solvent when it is time for me to receive benefits?

Should I take Social Security early or wait until age 70 and get the highest possible amount?

Normally our newsletters top out at around 1,000 words. Given the importance and complexity of this topic (with my apologies). this edition weighs in at nearly 2,000. We encourage you to read it from start to finish, plan ahead as suggested, and share with friends, family members of all ages and work colleagues.

First, Let’s Recap

Most people know that Social Security was designed as a financial backstop to help people avoid penury in old age. However, because people are living much longer than the lawmakers and 20th Century actuaries anticipated, the financial health of the program is in trouble.

Up to about 2010, benefits that the program paid out were being covered by the FICA taxes that we all pay. However, according to Social Security specialist and speaker Mary Beth Franklin, here’s what happened next:

“When the big financial crisis of 2010 hit and a lot of people lost their jobs and the first wave of boomers started to retire there was not enough money from FICA tax revenues alone to pay off benefits. That’s when we started tapping interest on the $3 trillion trust funds. That was fine until about 2021, and the pandemic hit and a lot more people lost their jobs. Interest on the trust funds was not enough to pay benefits, and we actually had to start drawing down the funds themselves. And that’s what we’re doing now.”

If Washington does nothing between now and 2033 or 2034, the trust funds will run dry. At that point, according to Social Security Administration trustees, there would only be enough FICA taxes coming in to fund about 79% of benefits.

Luckily, Congress is riding to the rescue. Just kidding. Fixing this well understood problem would require a combination of reducing benefits and increasing taxes which is why neither Republicans nor Democrats have done anything for 40 years and counting. Sooner or later though policymakers will be forced to pay attention. When they do, they’ll find that changes to Social Security are unavoidable.

Will Social Security Run Out of Money When it’s My Turn?

Boomers Will Likely Be OK (We Think)

The way the current law is written, if the reserve account runs dry then all beneficiaries would see a 21% reduction to their monthly benefits based on current estimates.

If you were born before 1964 and reach “Full Retirement Age” of 69 in 2033, we think the odds are low that you will see a reduction. Congress does not like to tick off old people, who vote in high numbers. By the time we get to 2037, we’ll have 70 million Social Security beneficiaries. Congress is likely to step in, even if it’s at the last minute, like they did in 1983 when Social Security was in danger of not being able to pay full benefits. Social Security has never missed a payment in its nearly 90 year history.

It’s more likely that they pass legislation that changes benefits, beneficiaries’ retirement age or the FICA taxes that employees and employers pay to fund the program.

Gen X May Need To Worry

Gen X, born between 1965 and 1980, is between the ages of 44 and 59 today. You are in a more precarious planning situation because while your benefits may be cut, you don’t have a ton of time to plan and save in advance. Many will still be working in 2033 and could see big tax increases to cover the shortfall.

Adding to the complexity is that this group could also be split into two sub-groups: those between 53 and 59 and those 44 to 53 today. The older subgroup will be 62 to 68 in 2033, all eligible to claim at least early retirement benefits. The unanswerable question is will Congress grandfather the older subgroup since they will be 62 and social security eligible in 2033?

Millennials Have A Much Longer View…But Also May Be Disappointed

For individuals who are 28 – 43 years old today (born 1981 – 1996), current estimates of future Social Security benefits seem bound to change dramatically over the next 20-30 years. It’s also likely that your payroll taxes will continue to go up to cover the shortfall for those who came before. The thin silver lining is you have many years ahead to hedge your bets by adjusting career options, spending habits, and importantly, savings strategies.

How To Plan Around the Possibility of Reduced Benefits

Planning for what may or may not happen to Social Security might sounds like a problem for Boomers alone. The reality is that young people have a lot more to worry about. It may all seem far off but our recommendation is to ‘stress test’ your financial plan for a 20% reduction in Social Security whether you listen to Taylor Swift, Taylor Dayne or James Taylor.

Hypothetically, if SSI ends up representing 1/3rd of your income in retirement, that 20% reduction would translate to a 6.7% pay cut. Luckily, if you have done a retirement projection or financial plan with us in the last few years, we have already done this stress test for you, as well as looking at other contingencies such as the risk of a long-term care need or a prolonged market decline. As we approach 2033 and possible Congressional solutions to this problem come into focus, we will continue to adjust your plan.

Should I Take Social Security Early or Wait?

To add to the anxiety around Social Security is the irrevocable choice we will all eventually have to make: whether to take our benefits as soon as we are eligible at age 62, wait until age 70 to get maximum benefits, or start somewhere in between.

First it should be understood that for every year you delay taking Social Security once you are eligible, the benefit increases by 8% permanently. However, people often elect to take benefits early for a variety of reasons including scary headlines, confusion or anecdotes from friends and fist-wagging uncles.

Although 37% of Americans regret claiming Social Security benefits early, some reasons for starting early are very legitimate. Let’s address the most common:

I Paid into the System My Whole Life and I Want to Get My Money Out (Dammit)!

Leaving money on the table is never a good feeling. If you feel strongly enough about this to want to take benefits early, just make sure that taking a reduced benefit will not harm you over the long-term. Small, permanent changes to your income tend to compound over time so you might not feel the effects of a decision to elect early until much later in retirement. Our recommendation is to do a retirement projection and consider whether longevity runs in your family. You may want to consider weighing the risk of premature death against the more financially consequential risk of longevity.

If I Die Early, I Won’t Get My Share

Unlike milk, none of us come with a stamped expiration date. However, health is a valid concern and a big reason people take Social Security early: 35% of Americans who filed at 62 mentioned family health issues as a factor in their decision.

In our experience, the break-even point between taking benefits early or delaying is a life expectancy in the early 80’s. If you have a known medical concern or something runs in the family, filing early might make sense because if you wait until 70, you might not live long enough to enjoy your benefits.

I Need the Money Now

Unanticipated job loss is another leading reason people choose to file early for Social Security. About 7 in 10 retirees say they were forced to stop working earlier than expected due to reasons beyond their control. Without enough savings to cover living expenses, taking Social Security early could provide a steady income to help pay bills and get through a tough time.

If you need the money, go ahead and take it, but this decision should still involve some planning. In an emergency, perhaps taking Social Security for a time can be stop gap but if you regain employment within a year, you actually have a one-time opportunity to revoke your application. The process is relatively simple, but there are conditions to be aware of:

You have one year from the date you filed to withdraw your application.

You will be required to repay all benefits received.

Social Security Might Run Out and I Want to Get While the Gettin’s Good

As we discussed in the previous section, there is a lot of uncertainty surrounding the Social Security trust funds being able to pay full benefits in the future. It’s very tempting to want to start taking benefits early than supposedly lose benefits later. However, as we said above, in the event the trust funds run out in 2033, it will not be a total wipe out – more likely a 21% reduction in benefits if Congress does nothing (and based on current demographics).

There’s also a real cost in betting that Congress won’t act. If you’re going to take benefits early, let’s say your full retirement age is 67 and you claim now at age 62, you’ll take a 30% cut. Then, if your worst-case scenario happens and benefits are cut another 20% on top of that, you would be hit with a total 50% benefits haircut.

According to Mary Beth Franklin. “If you don’t need the money and you’re claiming Social Security out of fear, it’s like selling stocks in a down market.”

Couples, Pay Attention!

For married couples, keep in mind that when the first spouse dies, you will lose the lower of your two social security paychecks. If you are depending on both these incomes in retirement, or if one spouse has a significantly higher benefit than the other, the need for careful social security election planning is paramount.

Last But Not Least

The conclusion is rather than Social Security being a problem for seniors, it’s actually a problem for younger people. Our recommendation is continued contingency planning with your Longwave advisor but also to consider political engagement. They say SSI is a pocketbook issue for Seniors. It should be a pocketbook issue for all. Contact your Representatives in Congress. And cast your vote for those supporting Social Security solvency.

This material is intended for informational/educational purposes only and should not be construed as investment advice, a solicitation, or a recommendation to buy or sell any security or investment product. Please contact your financial professional for more information specific to your situation.

Diversification does not assure a profit or protect against loss in declining markets, and diversification cannot guarantee that any objective or goal will be achieved.