Changing Channels: Why Interest Rates Matter More to Your Finances than Elections

Elections elicit strong emotions and emotions drive us to act. Today, investors from both sides of the political divide are being tempted to make portfolio changes based on who they think might win in November. History suggests however that elections have little impact on stock market performance. Even the notion that the stock market prefers a Republican president is wrong (it prefers a split government).

If you are looking for clues about your future financial well-being, you’re better off focusing on interest rates. Generally speaking, high interest rates slow the economy and low interest rates boost the economy. Interest rates impact everything from your retirement outlook, how much home you can buy and whether your child can afford those private school loans or should opt for State U.

Although the Fed is supposed to be independent in setting interest rate policy, the President selects its director (currently Jerome Powell) and can also exert verbal pressure on the agency. Prognosticators are already trying to guess how a Republican or Democratic President would influence interest rates. We would not pay too much attention to those predictions.

Interest rates are bigger than the presidency, bigger even than the economy. If the stock market is like a wave, driven by weather, interest rates are like the tides, driven by gravity.

Just a few years ago, interest rates were near zero but today you can easily get a 5% yield from your savings account. It may feel like we are being whipsawed by falling and rising interest rates but in reality, interest rates tend to roll along rhythmically, over multi-decade time frames.

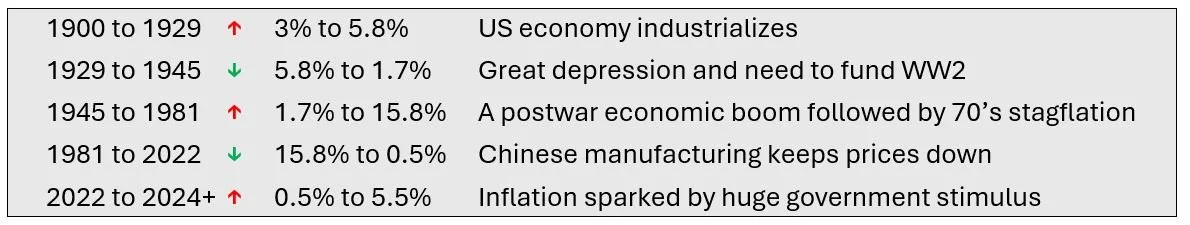

From 1900 to 2022, there were 4 major interest rates ‘waves’ with an average duration of 30 years.

There are many possible underlying reasons why interest rates rise and fall periodically. Theories include scarcity or abundance of natural resources, monetary policy and changes in population demographics. Whatever the reasons, what seems to be true is these periods are long, as are the economic consequences.

In the last cycle which lasted 40 years, Americans got used to broadly falling interest rates. That meant being able to refinance a mortgage to a lower rate every few years. Homeowners could cash out equity, borrow for repairs, or afford to move to a bigger or better house. Companies and real estate investors could borrow cheaply to increase profits, reinvest in their businesses or buy-back shares.

But low interest rates also posed challenges for savers and investors. Yields on cash in savings accounts and bonds fell to almost zero. A typical investor who had 40% of their portfolio in bonds would have to settle for a paltry return from that part of their portfolio. Insurance costs went up (especially for long-term care) to account for the lower returns insurance companies were receiving on their float. Pensions had to be recalibrated.

Now we are perhaps on the verge of a new multi-decade period where interest rates gradually rise or at least stay elevated compared to what we have gotten used to. As planners, we like to look at many scenarios and risk factors that may affect our client’s financial plans. While the future can be impossible to predict, we still like to ask ‘what if’.

Three Consequences of Higher Rates on Financial Plans

Inflation Can Be a Drag on a Retirement Projection

Might you run out of money in retirement? A financial advisor’s prediction is based primarily on estimated investment returns, spending and life expectancy. High inflation can therefore absolutely be a financial drag in retirement. Inflation causes everything we buy, including goods, services, housing and healthcare to become more expensive and social security payments to be less valuable.

For the past 15 years many advisors used 2% as the long-term rate of inflation. If today we begin using 3%, it would make retirement projections look a little worse. While moderately higher interest rates have been found to actually be good for stock prices, we will want to revisit our financial plans to stress-test what would happen if the cost of things goes up faster than we had anticipated.

High Interest Rates Can Make Bonds More Attractive Than Cash

Imagine going back to 1981 and buying a 30-year US Treasury Bond paying 16%. You would have locked in that 16% coupon until 2011!

From 2022 to 2024, as interest rates started to go up again, the best way to take advantage was purchasing rate sensitive investments like Money Market funds.

Today, prevailing wisdom is that interest rates will not go higher but could actually come down at some point soon. If an investor has cash or a cash-alternative like Money Market in an account earmarked for a long-term goal like retirement, it may be time to lock in those high rates by shifting into medium to long term bonds. As an additional benefit, bonds can provide greater diversification to a portfolio than cash.

Delaying Social Security Could Make More Sense than Ever

Each year you delay taking Social Security, you are effectively achieving a guaranteed return that is comparable to, or even higher than, what you might earn from other investments. Social Security benefits are guaranteed for life and adjusted for inflation (via cost-of-living adjustments). Waiting as long as possible to start getting your benefits may ensure the highest possible guaranteed income stream in the future.

Overall, the impact of high interest rates on a financial plan depends on individual circumstances, including debt levels, investment mix, and economic conditions. It's why we regularly review and adjust our client’s financial strategies while stress testing different alternative possibilities. Having a plan and preparing for contingencies is the best way to handle unforeseen circumstances and an uncertain world.

Fun fact: The name of our firm “Longwave” was inspired by “The Great Wave” written by historian David Hackett Fischer. Fischer’s identifies price (inflation) revolutions that form patterns in the history of Western Civilization: the High Middle Ages, the Renaissance, the Enlightenment, and finally the Victorian Age. Are we living through a pattern change today? We likely won't know for several decades or until a future edition of this great book.

This material is intended for informational/educational purposes only and should not be construed as investment advice, a solicitation, or a recommendation to buy or sell any security or investment product. Please contact your financial professional for more information specific to your situation.

Diversification does not assure a profit or protect against loss in declining markets, and diversification cannot guarantee that any objective or goal will be achieved.