Divest, Enhance or Impact: What Kind of Values Investor are You?

If you attend a comic book convention, you better not confuse Star Trek with Star Wars. Those fans are passionate and will eat you alive!

Values investors are equally passionate, choosing to align their investments with causes they care about deeply such as the environment or social justice. Organizations seeking to align their endowment assets with their principles are likely to be just as committed. God help an investment company that slaps a ‘green’ label on a fund just to sell more products.

Unfortunately, most investors don’t have the knowledge to evaluate whether an investment addresses their values authentically. Furthermore, there’s a lot of confusing marketing of investment products out there. The various labels make it hard to navigate: impact, activist, ESG, green, sustainable, socially responsible investing (SRI), fossil-fuel free, conscious capital, and so on. An example where a label can be misleading is ‘Fossil-Fuel Free’. Practically speaking, no company or industry today can avoid fossil fuels entirely across an entire operation, and regulators feel this way as well.

Given this landscape, it’s not surprising that a question we get a lot is “what’s in my portfolio?”

Before we can make sense of this jargon, let’s start with what is important to you or your organization! When you think about how you want your investments positioned, which of the following statements is most meaningful:

1. I want to avoid investing in companies that go against my beliefs and values.

2. I want to seek out investments that could benefit from future environmental and social trends.

3. I want my investments to have an altruistic purpose and am willing to give up some returns.

Now that you have made your choice, let’s discuss how each statement translates into a specific investment approach that you can adopt.

Avoid Companies that Go Against my Beliefs and Values

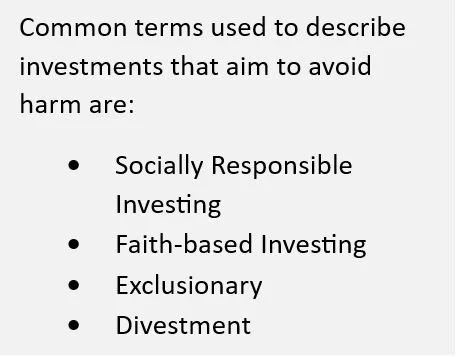

If your choice was #1, we would define your investment objective as seeking to reduce harm or, in financial parlance, Divestment. As the words suggest, reducing harm generally means avoiding or underweighting companies that you perceive to cause societal, moral or environmental damage. Common examples of businesses that values-investors seek to avoid are chemicals, tobacco, firearms, oil & gas, mining, animal testing and private prisons.

Of course, values can be very personal so it’s important to navigate this space carefully – faith-based value screens may exclude companies that provide abortion access (Catholic) or pay interest (Sharia).

This approach generally focuses on excluding companies, rather than proactively seeking companies that you believe are socially good. In addition to the moral logic, there is the additional perspective that companies that mistreat their employees, customers, and communities, may underperform in the long run.

Enhance

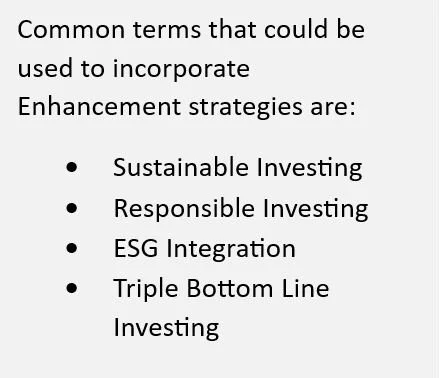

If you picked the second statement, we would say you are looking to Enhance returns or reduce risk by seeking out investments that could benefit from societal trends. This approach emerged prominently in the early 2000s, drawing inspiration from the UN's Environmental, Social, and Governance (ESG) framework and Sustainable Development Goals.

The underlying thesis is that the next half-century will witness a significant shift towards renewable sources of energy, with diminishing reliance on oil and gas, and a growing ecosystem of responsible businesses. This method assumes as consumers become increasingly informed, companies with strong ESG credentials may outperform.

Funds focused on enhancing returns are typically concentrated in a small, curated number of companies that are traded more frequently.

Investing with an Altruistic Purpose

If you chose the third option, we would say that you are looking for your investments to make an Impact. As you might imagine, the bar to qualify as an impact investment is quite high. Generally, to be considered an impact investment there has to be a direct link between your investment dollar and a tangible, quantifiable social, sustainable, or developmental outcome. Also, those seeking impact are generally willing to accept a lower investment return to achieve a social or environmental return.

According to the Global Impact Investing Network (GIIN) the measurability criteria disqualifies most investments from being considered “impact”. Examples that meet GIIN standards are investments such as microfinance loans to underserved communities, private green energy development funds, and direct investments towards social or sustainable outcomes.

Your Vote, Your Voice

As a values investor, you are wielding the power of your capital, which may help influence change. We have often seen the impact of this power, including on South African apartheid policy in the 70’s and 80’s and perhaps in the year ahead we shall see something similar due to current political unrest. However, as a shareholder in all the companies you provide capital to, you have additional muscle – the power of your vote in how those companies are run.

We call this power Shareholder Engagement or Shareholder Activism. Stockholders in most public companies have the ability to vote their shares on matters such as corporate initiatives and the election of board members. Shareholder engagement covers a host of strategies investors use to influence the policies and practices of their portfolio companies on questions of environmental and social risk. The range of engagement strategies includes proxy voting on shareholder proposals to participating in investor letters and statements to direct engagement of management via dialogues and the filing of shareholder proposals, among others.

Although at Longwave we don’t invest in individual companies directly, we invest in mutual funds and exchange traded funds that are active shareholders in the companies they own. Some of the largest index fund providers such as Vanguard, BlackRock and State Street have made headlines as they have moved away from engaging and voting proxies based on values or ESG related issues as they believe these issues are not material to investment returns. We disagree. The funds we select for our values-based portfolios are specifically selected because of their active engagement around these issues.

The Longwave Way

As you have seen, there are many ways to approach values-based investing. Perhaps with this newsletter you have gained insight into what specifically is important to you. At Longwave we employ a multi-layered approach to evaluating and selecting funds for our values-based portfolios. While we lean most heavily into the Divestment approach, we also aim to create positive change and enhance returns through our recommended funds’ shareholder activism. Stay tuned for our next newsletter where we will outline our approach in more detail!

Investments are subject to risk, including the loss of principal. Environmental, social, and governance (ESG) criteria is based on a set of nonfinancial principles in addition to financial principles used to evaluate potential investments. The incorporation of nonfinancial principles (i.e., ESG) can factor heavily into the security selection process. The investment’s ESG focus may limit investment options available to the investor. Past performance is no guarantee of future results.

Investments are subject to risk, including the loss of principal. Some investments are not suitable for all investors, and there is no guarantee that any investing goal will be met. Past performance is no guarantee of future results. Talk to your financial advisor before making any investing decisions.

All indices are unmanaged, and investors cannot actually invest directly into an index. Unlike investments, indices do not incur management fees, charges, or expenses. Past performance does not guarantee future results.

i Global Impact Investing Network: What You Need To Know about Impact Investing: https://thegiin.org/publication/post/about-impact-investing/

ii Global Impact Investing Network: What You Need To Know about Impact Investing: https://thegiin.org/publication/post/about-impact-investing/

iii ESG Dive: State Street reduces support for E + S proposals, following other Big Three asset managers: https://www.esgdive.com/news/state-street-2024-asset-stewardship-report-environmental-social-shareholder-proposal-support-falls/727798/