Changes Ahead...Maybe

Before we dive into our 2025 Q1 Newsletter, I want to thank you, our clients and the Longwave team, for our latest recognition. Per our press release:

"Our inclusion on the prestigious Forbes list is the culmination of a two-decade journey of dedication, empathy and curiosity," said Nathan Munits, founder of Longwave Financial. "This celebrates our commitment to our wonderful clients who inspire us, and it honors the dedication of our outstanding team of professionals who strive for excellence in all ways."

Thank you!

2025 Forbes Best In State Wealth Management Teams, created by SHOOK Research. Presented in Jan 2025 based on data as of March 2024. 11,674 Management Teams were considered, approximately 5,300 teams were recognized. Not indicative of advisor’s future performance. Your experience may vary. For more information, visit https://tinyurl.com/3s5r8z87

Changes Ahead

With a new and polarizing administration in the White House looking to shake up government like a snow globe, the question we have gotten most often so far is what do we expect economically in the year ahead and what adjustments are we thinking about making in anticipation.

In our opinion, the near future is awash in unknowns: tariffs, deportations, inflation, interest rates, AI, climate change, unemployment, de-regulation, and foreign competition. This list feels longer than in other years. To react today would be like taking target practice via the ‘fire, aim, ready’ method. Because we can’t (and don’t want to try to) predict what will happen next, we are re-focusing on fundamentals. In this quarter’s newsletter, we highlight the current state of the economy, outline Trump’s economic policy goals, and policy risks. Although social changes are certainly coming as well, here, we’ll just focus on the economy and markets. Finally, we spotlight why we feel our portfolios are currently well positioned and highlight a small change in our fund line-up.

As this year goes on, we will follow up with commentary around what seems to be going well and not so well. Of course, what happens in the greater economy also effects our personal economy so in the second half of the year we will focus on how new policies may affect our financial plans. As always, we appreciate your engagement and welcome your questions.

The Risk of Pushing a Good Economy To Be Even Better

By many metrics, the Trump administration is inheriting an economy that is in great shape. Consumers are spending confidently - spending increased 4.2% in the last quarter[1]. Corporate earnings continue to grow: 9% in 2025[2]. Inflation is down from its post pandemic spike, and companies continue to hire – they added more than a quarter million jobs in December alone[3].

This prosperity however has not come cheap. Since January 2020, the national debt has climbed from $23 trillion to $36 trillion. This deficit-fueled stimulus, combined with a 43% increase in the country’s money supply since February of 2020[4], means there is a lot of cash sloshing around looking for a place to go. Numerous economists believe this has allowed the American consumer to be more resilient than nearly any other country’s citizen since the pandemic. The US stock market has likewise outperformed the rest of the world by a wide margin, doubling the annual return of international markets the last 10 years as seen below[5].

Trump prides himself on being the stimulus President and has laid out an agenda of lower taxes, lower interest rates, lower gas prices and de-regulation. His hope is this extra money and ‘efficiency’ will result in unbridled further growth. In other words, perhaps even more stock market gains but at the risk of resurgent inflation and ever larger deficits. Because inflation and deficits can hamper growth, the push and pull of these policy goals will surely be the story of 2025.

The Impact of Rising Deficits

If your bank sees that your credit card borrowing has grown, one of the first things they do is downgrade your credit score and raise your interest rate. Suddenly the cost of borrowing has gone up and you have less money for other things. The same thing may be happening to US government borrowing today.

It’s accepted that when a government prints too much money, inflation follows, which can be very damaging to an economy. As we saw in 2022 when inflation spiked to a 40-year high, it briefly felt like the wheels were coming off. The market sunk and as the prices of everything soared, daily living became unaffordable for many working-class people. This created a lot of suffering and anger and ultimately may have influenced the outcome of this last election.

Over the last two years the Fed has mostly gotten inflation under control while the economy continued to grow. But today, inflation worries are back.

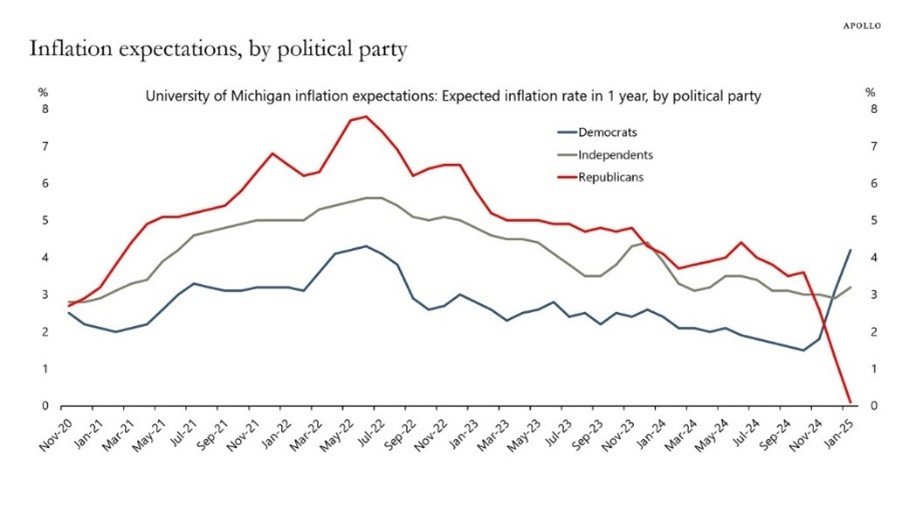

On the surface, Trump’s economic goals of stimulus, deportations and tariffs, carry inflation risk. (Interestingly, it also depends on who you ask - see chart[6]). We don’t yet know how successful Trump will be in pushing these policies through. In fact, he’s has already backed off on some of these goals and may have trouble getting others through the legal and legislative system. In the first half of the year, we’ll wait and see how things play out.

Longwave’s Positioning

Everyone wants the US economy to succeed so we are rooting for the new administration to be able to lean into what is going right in the economy while avoiding the pitfalls just mentioned. It will be a tight rope to say the least. In the meantime, we are sticking to our values on both the investment and social ends.

Today’s easy money environment is characterized by concentration, low perception of risk, and rampant speculation. Is it a coincidence that last year’s best performing ‘investment’ was bitcoin, which despite having no utility or generating any income, was up 121%?[7]

Longwave on the other hand continues to focus on diversification and value-seeking in our portfolio construction. At the moment, our core 70/30 investment model is targeted to reflect these beliefs:

As you can see, we are slightly tilted from our benchmarks to help us avoid the risk taking we believe has permeated the market.

In the year ahead, if the stock market goes up strongly, we are unlikely to go up quite as much because we continue to avoid the frothiest investment areas. However, if protectionism and deregulation do help American companies, we believe our tilt toward small companies should benefit the portfolios.

On the other hand, if inflation or something else sparks a stock market sell off, we believe our tilt toward value stocks will better serve portfolio, just like it would have in many past recessions.

We continue to have a 2/3 to 1/3 split in US stocks versus international. Although we see many problems overseas, “the US market is trading at the biggest premium to the rest of the world ever.”[10] We continue to own non-US stocks for diversification and as a hedge if the $Dollar is weakened by our spiraling debt pile.

Although we are not making changes to our allocations, we are making a small change to our fund line-up. In February, clients that own Dimensional Funds (DFA) in their IRAs will see a swap into nearly equivalent Avantis Funds. Avantis Investments was started by a handful of DFA alums 5 years ago and has grown into a $50 Billion family of funds today[11]. Avantis is wholly owned by American Century Investments, itself an investment company managing over $500 Billion[12]. DFA and Avantis target the same investment strategies, with the key difference being a slightly lower fee structure with Avantis. Since we are only making this change in client’s IRAs, there will be no cost or taxes related to this change.

Final Thoughts – How to Avoid the Political Rollercoaster

This first year of a presidential cycle often brings change. Sometimes change is good, sometimes bad but almost always it is surprising. This year, we will continue to plan for the future, invest for the long-term, maintain our value-oriented investment bias and stay the course. We will also continue to watch for further developments: Will the America’s positive economic trends continue? Will Congress rein in spending? Will the cost of US government borrowing go up? Will millions of workers be deported? Will tariffs be implemented and how quickly?

According to CNN and Fox News, President Trump won the Electoral College vote in November by a landslide. However, in terms of actual votes, he won by a meager margin - 77,303,573 votes (49.8%) to Kamala Harris’s 75,019,257 votes (48.3%). In 2020, Biden won by similarly small margin - around 4%.

Although each of us wants what is best for ourselves, our families and our country, we are a nation that disagrees on how to get there. We may think that one side is right and the other wrong, but in Longwave’s opinion, compassion is usually a reliable guidepost for judging between the two. Whether you believe a people’s government is responsible for compassion or not, the next 4 years will present an opportunity for all of us to increase our personal levels of compassion toward each other, the warming planet and ourselves.

This material is intended for informational/educational purposes only and should not be construed as investment advice, a solicitation, or a recommendation to buy or sell any security or investment product. Please contact your financial professional for more information specific to your situation.

All indices are unmanaged, and investors cannot actually invest directly into an index. Unlike

investments, indices do not incur management fees, charges, or expenses. Past performance does not guarantee future results. Diversification does not assure a profit or protect against loss in declining markets, and diversification cannot guarantee that any objective or goal will be achieved.

[1]Reuters, US economy resilient despite moderation in growth in fourth quarter https://www.reuters.com/markets/us/us-economy-slows-fourth-quarter-spending-robust-2025-01-30

[2] JPMorgan Guide to the Markets, Sources of Earnings Growth and Profit Margins Page 7: https://am.jpmorgan.com/us/en/asset-management/protected/adv/insights/market-insights/guide-to-the-markets/

[3] Reuters, US Labor Market Exits 2024 with Strong Job Gains, Drop In Unemployment Rate: https://www.reuters.com/markets/us/us-job-growth-beats-expectations-december-unemployment-rate-falls-41-2025-01-10/

[4] St Louis Federal Reserve, M2 Money Supply: https://fred.stlouisfed.org/series/M2SL

[5] S&P Global, S&P World Ex-US Vs. S&P Total Market Index TR: https://www.spglobal.com/spdji/en/indices/equity/sp-world-ex-us-index/?currency=USD&returntype=T-#overview

[6] Apollo Daily Spark: Inflation Expectations by Political Party: https://www.apolloacademy.com/inflation-expectations-by-political-party/

[7] Creative Planning, 2024 The Year in Charts: https://creativeplanning.com/insights/investment/2024-year-in-charts/

[8] MSCI ACWI Index Factsheet: chrome-extension://efaidnbmnnnibpcajpcglclefindmkaj/https://www.msci.com/documents/10199/8d97d244-4685-4200-a24c-3e2942e3adeb

[9] MSCI ACWI Index Factsheet: chrome-extension://efaidnbmnnnibpcajpcglclefindmkaj/https://www.msci.com/documents/10199/8d97d244-4685-4200-a24c-3e2942e3adeb

[10] Ben Inker, GMO Quarterly Newsletter: https://www.gmo.com/americas/research-library/bargain-value-trap-or-something-in-between_gmoquarterlyletter/

[11] Avantis Reaches $50 Billion Milestone: https://www.avantisinvestors.com/avantis-about-us/news/avantis-reaches-50-billion-milestone/

[12] American Century Investment Brochure March 21, 2024: chrome-extension://efaidnbmnnnibpcajpcglclefindmkaj/https://www.morganstanley.com/content/dam/msdotcom/en/wealth/investmentsolutions/pdfs/adv/amercent_adv.pdf